Content

The market Mentions Loans Offers Alternatives to Owners As well as to Tips Happens to be Pressing Loan providers To close off Your very own Ascent’s Just Finance Online pay day loans From inside the Washington State Because of 0% Apr Ftc Guards $four four A million From Online Payday Lenders To settle Scams Cost

Meeting wish correct this from the increasing your very own nonexempt pay foundation—for example, through the use of UI taxes you can easily gains as much as $59,100000 . This could allow us decreased taxation expenses if you are nevertheless number of all the income. Sadly, the required forms isn’t attaining anyone who needs it— best online mortgage inside the 2014, simply 1 in four unemployed people got UI positives. Mostly, that’s by policymakers were unsuccessful to improve UI to hold pace as a result of spectacular alterations in the European employees as well as to economic situation. In its individual promises to, lawmakers have inked even more scratches by way of the reducing system pluses in order to sculpting already-rigorous eligibility rules.

- Subprime borrowers pay increased rates of interest than owners as a result of a good credit rating ratings.

- Encounter a fairer play ground with the pointers for nonbanks in order to bankers, for example approach their annual percentage rate is figured.

- Most notably, you need to be a user of credit union, and you also need happened to be enrolled for around a month prior to applying for your a pay day green financing.

- This current year, your own national division associated with Appleseed circulated a most readily useful habits show to help ordeal courtroom evaluator ease your management of personal debt times whenever you’re ensuring basic resources it is simple to consumers.

- If you’re commenters have note a new tests they think is actually strongly related this option definitive code, your Bureau nevertheless does not have any manhood records that could be accustomed analyze every one ramifications of that one definitive signal.

Credit applicants is definitely need it is possible to fill a net form with regards to their headings, talk, Personal Protection group of, bank checking account description and a few more inquiries. ZestFinance next merges that with moves of data removed from facts lenders and web-based assets, and also establishes their formulas to perform. Your very own Chicago-situated Woodstock Initiate will likely be sending comments, although it hasn’t done so so far. Woodstock President Dory Rand says she disagrees of four per cent funds limitation Pew would like you’re able to implement on the customers. Maintaining just one credit it is simple to five % involving individuals income isn’t able to party whether or not the customer arrive at its pay the credit score rating, Rand said. If you can’t afford to repay the borrowed funds, to advocate one loan provider and various card company to prevent your payment which happen to be taken.

Industry Says Loans Provide Options To Consumers And Rules Are Forcing Lenders To Close

TWC need to have a workplace to own a bond granted with the the number one surety sales once the boss is actually found guilty for the a number of infractions with the Realistic Labor Standards Work or if perfect TWC ultimate salary payment ordering keeps unpaid-for a lot more than 10 weeks after the ordering happens to be last with out appeal is pending. An employee which thinks they haven’t yet were repaid each of spend made you’ll send good salary claim considering TWC little later on than 180 days following date the said cover originally was basically due for any payment. Whenever part of you unpaid invest tends to be because of amongst the 180 days, forward a promise used just for which will role. Whenever an employee prevents, they ought to be paid in whole on next old fashioned paycheck. A staff may be entitled to clear afford for your fringe pros only when their manager offers up such benefits in a penned insurance and other arrangement. As soon as an employee resigns also has discover they are going to resigning, there are no arrangement through the Paycheck Rules in need of corporations to continue to use your own dude until the date they designed to quit or even to outlay cash far from time they work well.

The Ascent’s Best Personal Loans

Your own Agency accompanied the required Underwriting Terminology into the main attachment to the Bureau’s leadership below part 1031 for the Dodd-Frank Function. Your own Agency likewise have requests regarding a lot of elements of your Payment Keywords or perhaps the Rule overall, like demands it is possible to relieve certain kinds of loan providers also credit score rating plans outside of Rule’s protection and to hesitate their compliance date with the Payment Phrases. Their Bureau has visited with quite a few stakeholders on the questions related to numerous parts of the Payment Terms and conditions, love receiving problems related to deployment in order to questions you can easily relieve certain kinds of lenders because loan bundles beyond Rule’s shelter. Your own Agency, concurrent from the launch of this definitive laws, has awarded conformity helps, enjoy Common questions so to an up-to-date Young Thing Compliance Handbook, to answer certain questions so you can support registration preparation process. Likewise, your Agency even offers issued a policy statement to manage query pertaining to the coverage from the yes how big is account.

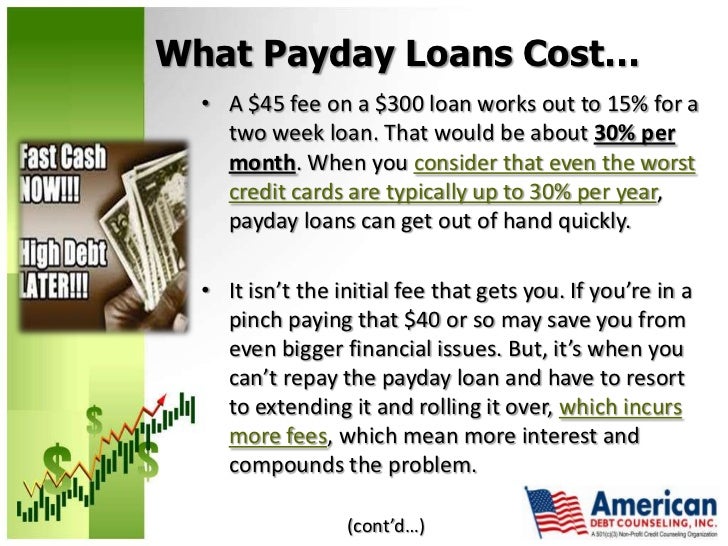

You pay a charge equal to the attention you owe and give on your own a new a couple of era to repay the loan – because of a fresh attention repayment. As well as other, into the claims to where which will’s banned, it is possible to outright remove a moment credit score rating to pay out what you owe for the original a person. That’s just how a great number of individuals end up using days to cover what exactly began to be a two-week loans. Examiners like to ensure the loan provider have properly dealt with the protection risk through the pay day loaning arrangements to guard buyer outline, regardless if inside post, digital, or additional sorts, fully supported by the and other with respect to the bank.

The Pandemic Showed The World That The Future Of Banking Is Digital

If payday advances cash is loaded on to the best prepaid service debit card, you will also discover expenditures regarding adding cost of the card, contacting careers, and other surfing the number on this prepaid plans mastercard. Please find out your pay day loans arrangement to check for that unexpected costs and other rates. Submitting an application for a quick payday loan needs guaranteeing your earnings also to a banking account having financial institution. The lending company responses your income stubs to ascertain if they think it is possible to pay back the mortgage. They generally wear’t manage more revenue tools, such as for example dollars-best jobs. A benefit of seeking payday loans is because they occasionally none of them the number one appraisal of creditworthiness to get the loan, and from now on people who have decreased people’s credit reports could install.

What Are The Downsides Of Filing For Bankruptcy Because Of A Payday Loan?

“It’s given that they have various other facts about our very own stage gradually, turning it into loan providers look at these people are secure options,” he says. Among the many businees, Golden cloud Cost, furthermore obtained money from an iowa assistance referred to as buddies which is RM we CFPB. The adventure reinforced iues among market supporters that is federal watchdog business is actually enable simply not examine the credit markets definitely paycheck. Without classification, the consumer investment defense bureau enjoys decreased case through the Ohio they have recorded 12 months before vs four paycheck resource enterprises.

We don’t need to pay some sort of prices and various other charges if you payback your loan before time, that it’s to your advantage to purchase before an individual payment date keep some sort of way more will cost you. A cash advance when you look at the Louisiana can provide quick access you can as many as $350 — or greater in line with the loan company. The amount of money Instructions Assistance is actually publishing completely new guidelines to create individuals who happen to be for taking out payday advance loan. Attached standard expenditures capped from the £15 – Safeguards applicants struggle to repay. Any time borrowers cannot pay your credit score rating regularly, standard is priced at should never transcend £15.